It is believed that the Fintech lending companies can effectively and pronouncedly solve the current health care crisis that the US is facing in terms of recruitment, expansion and most importantly in funding. Fintech money lending is in vogue now that has smoothened the lending process and has also taken out a major part of the risks inherited in such lending.

With these lending companies coming into the scenario, most banks and financial institutions have also started to contemplate lending to the health care industry once again after they pulled back a couple of years back. The primary reasons for pulling back by the banks and financial companies are considered to be:

- Apprehension of losses

- Very low or no recovery chances and

- This niche not being profitable enough.

However, it is noticed that after 2016, the size of the health care loan portfolio of the US banks and financial organizations started to grow. This included the loans provided to different practices and health care providers.

It is assumed that such a change in business approach by the banks, financial companies as well as the private online money lending sources such as https://www.libertylending.com/ is primarily due to the involvement and interest shown by the Fintech lending companies. It is, therefore, asserted that Fintech lending companies can resolve the health care crisis of America.

Also, the fact that this specific industry represents such a huge part of the country’s economy has also resulted in the Fintech lending companies taking part in financing the health care industry.

About the key

The key to lending health care service providers and practices needs to be followed however to make sure that no more losses are experienced by the lenders.

- The most primary requirement seems to be an increased discipline. Lenders must be extraordinarily focused on the evaluation of the inherited risks in such lending and proper management of these risks as well.

- Apart from that, having adequate expertise and knowledge about this specific industry is also critical. This will help the money lenders to differentiate from their competitors. Industry expertise always acts as the most positive differentiator among the myriad of money lenders who participate in this highly competitive lending space who seldom have a deep insight and experience regarding the healthcare industry.

It is only when the money lenders will find the interest and desired returns from their investment in the healthcare industry.

The situation at a glance

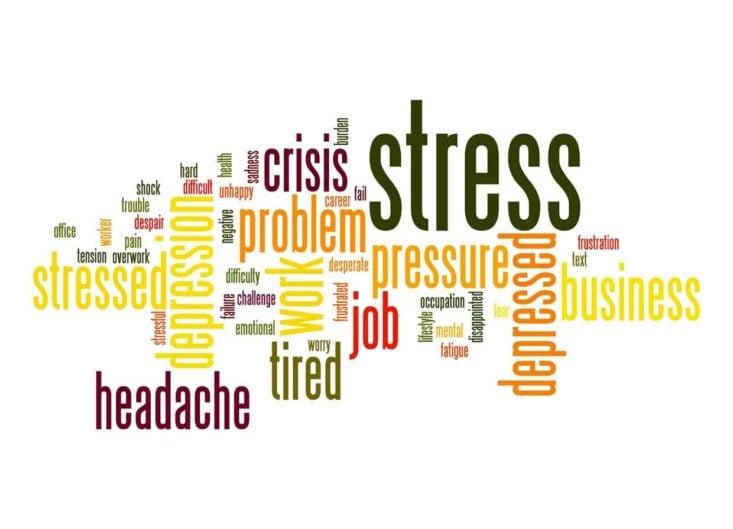

There are several different issues and reasons for America to face such a health care crisis. Apart from the problems of the health care practices and the providers, the people, in general, are also responsible significantly to add to the crisis.

- It is believed that about 57% of Americans cannot pay for medical bills and emergencies more than often. Most of the time, it is seen that most of the US citizens either have to sell their belongings in order to foot their medical bills or take on fresh loans to pay these bills and thereby fall into the debt hole.

- Another alarming factor is that given the current economic scenario, the rich are getting richer while the poor getting poorer. Therefore, most people have to live their lives from paycheck to paycheck and therefore are forced to turn to banks, financial organizations and other lines of credit to obtain loans to get the required medical care.

- Moreover, most of the people take out such loans from untraditional sources, therefore, having to pay a much higher cost for it in comparison to commercial banks and other financial corporations. This makes the situation even worse.

- People today carry more debts than they can repay. They also have fewer or no savings with which they can face and overcome the challenges that may come due to change or loss of jobs. In addition to that, a major portion of the American inhabitants does not have solid health insurance with which they can deal with any emergency medical situations.

- Along with the volatile income and low or no savings, the volatile costs of medical care force the people to turn towards medical loans which they cannot repay. In the process, they cannot come out of debt ever, save money, and build their wealth over time.

- Last and most probably the most significant issue is the rising rates of interest and the aftereffects of the economic recession have made the American citizens more vulnerable. They also fear the economic downturn in the future.

All these factors point towards one thing: The financial health crisis in America is highly likely to continue and will escalate at an alarming rate.

About the solution

The only resolution to this growing issue and financial problems in the health care industry seems to be driving into Fintech startups. This will help those who need funding the most and those who do not have a healthy financial situation.

There are several different ways in which these Finch lending companies can resolve this financial issue.

- It can offer Peer To Peer lending, commonly called P2P lending or through alternative investing. In the process, they will transform the banking industry making loans more accessible and affordable for the commons.

- Alternatively, Fintech lending companies may also provide better access to the asset class. They may encourage a set of new types of investors by offering new types of products through a better and newer distribution channel.

- As for the borrowers, they may provide them with the desired reliefs along with a better experience by investing in better and newer technology that will help them to enhance their quality of service, design better financial products and deliver more value to the customers.

- In addition to that, they may continue to fill in the credit gap by playing an important role by pursuing financial inclusion with affordable access to such credit. This they can do by leveraging technology once again as well as data insights along with it.

All these approaches will not only help the borrowers and the investors but the entire health care industry.